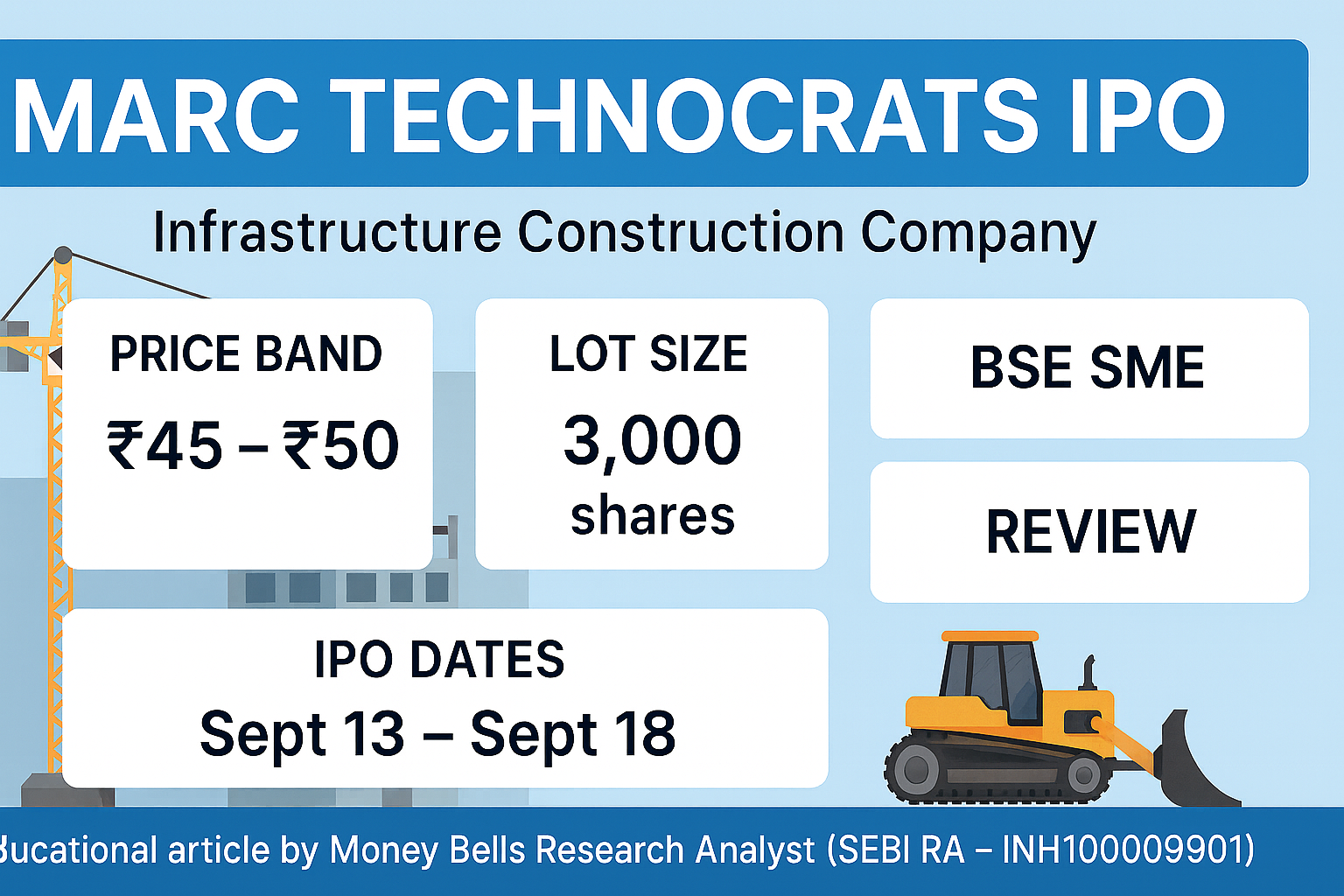

Marc Technocrats IPO: Price Band, Dates, Lot Size & Full Review

Marc Technocrats IPO – Price Band, Dates, Lot Size, Subscription, GMP & Full Review

Educational article by Money Bells Research Analyst (SEBI RA – INH100009901)

Marc Technocrats IPO Overview

Marc Technocrats Limited is a construction and engineering services company primarily engaged in infrastructure development projects, including piling, geotechnical solutions, and foundation engineering. The company serves both government and private sector clients across India.

The Marc Technocrats IPO offers investors an opportunity to participate in a niche infrastructure services company with experience in complex engineering projects.

About Marc Technocrats Limited

Marc Technocrats Limited provides specialized construction services such as bored piling, diaphragm walls, micro piling, soil stabilization, and ground engineering solutions. The company has executed projects across metros, highways, bridges, commercial buildings, and industrial infrastructure.

The company’s technical expertise and project execution capability form the backbone of its business model.

Marc Technocrats IPO Details

| IPO Type | SME IPO |

| Issue Type | Book Built Issue |

| Listing Platform | BSE SME |

| Face Value | ₹10 per share |

| Price Band | ₹45 – ₹50 per share |

| Registrar | Bigshare Services Pvt. Ltd. |

IPO Important Dates

| IPO Opens | 13 September 2023 |

| IPO Closes | 18 September 2023 |

| Basis of Allotment | 21 September 2023 |

| Refund Initiation | 22 September 2023 |

| Demat Credit | 25 September 2023 |

| Listing Date | 26 September 2023 |

Price Band & Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Minimum) | 1 | 3,000 | ₹1,50,000 |

| Retail (Maximum) | 1 | 3,000 | ₹1,50,000 |

| HNI (Minimum) | 2 | 6,000 | ₹3,00,000 |

Issue Size & Structure

| Total Issue Size | 30,00,000 shares (₹15 crore approx.) |

| Fresh Issue | 30,00,000 shares |

| Offer for Sale | Not Applicable |

IPO Share Reservation

| Retail Investors | 50% |

| Non-Institutional Investors (NII) | 50% |

| QIB | Not Applicable |

Company Financials (₹ Crore)

| Financial Year | Revenue | PAT |

|---|---|---|

| FY2021 | 65.13 | 1.02 |

| FY2022 | 71.80 | 1.35 |

| FY2023 | 104.85 | 4.60 |

Key Strengths

- Specialized expertise in foundation engineering

- Growing infrastructure demand in India

- Experienced management team

- Established client relationships

Risk Factors

- Project execution and delay risks

- Working capital intensive business

- Dependence on infrastructure spending

- SME listing liquidity risk

Subscription Status

The Marc Technocrats IPO received healthy interest across investor categories. Investors should always consider valuation, financials, and risk profile along with subscription numbers.

Grey Market Premium (GMP)

The GMP for Marc Technocrats IPO indicated moderate market interest at the time of issue. GMP is unofficial and should not be considered a guaranteed indicator of listing performance.

FAQs

Q1. Is Marc Technocrats an SME IPO?

Yes, the IPO is listed on the BSE SME platform.

Q2. What is the price band?

₹45 to ₹50 per share.

Q3. What is the lot size?

3,000 shares per lot.

Q4. What is the listing date?

26 September 2023.

Q5. Is this IPO suitable for long-term investors?

It may suit investors with high risk tolerance and long-term outlook.

Disclosure

Important: This article is for educational purposes only. Money Bells Global Research Services Pvt. Ltd. is a SEBI Registered Research Analyst (INH100009901).

Read full disclosure at: https://moneybells.in/resources/disclosure

IPO investments are subject to market risks. Please read the offer document carefully before investing.

.jpg)